Unlocking Business Potential with Superkredyty: Your Guide to Banks, Credit Unions, and Financial Advising

Understanding the Financial Landscape

In today's fast-paced business environment, having a firm grasp on the financial options available is essential for success. Businesses at every level face the challenge of securing the right funding to achieve their goals. By leveraging the resources available through https://superkredyty.com, entrepreneurs and business owners can gain a comprehensive understanding of their options. Whether it's through traditional banks, credit unions, or specialized financial advising, there are numerous paths to explore.

Why Choose Banks for Your Business Financing?

Banks have long been the backbone of business financing, providing a range of services tailored to meet the diverse needs of businesses. Here are several key reasons why working with banks might be advantageous:

- Diverse Loan Products: Banks offer various loan options, including term loans, lines of credit, and asset-based lending.

- Established Relationship: Engaging with a bank as your trusted financial partner can lead to favorable terms and access to additional resources.

- Expertise and Guidance: Many banks provide dedicated business advisors who can assist in navigating complex financial decisions.

- Online Services: With technological advancements, banks now offer online services which streamline application processes and account management.

Exploring Credit Unions: A Community Approach

Credit unions are member-owned financial cooperatives that often operate with a community-focused philosophy. For many businesses, credit unions can provide benefits that are unique compared to traditional banks:

- Lower Interest Rates: Credit unions typically offer more competitive interest rates on loans due to their non-profit structure.

- Personalized Service: Being member-focused, credit unions tend to provide a more personalized banking experience.

- Community Support: Working with a credit union often means supporting local initiatives and promoting community growth.

- Withdrawal Flexibility: Many credit unions have flexible withdrawal options that can be particularly beneficial for small businesses.

The Role of Financial Advising

Engaging a financial advisor can substantially impact your business strategy and funding approaches. Financial advisors offer crucial insights and can guide you through complex financial decisions:

- Customized Financial Strategies: Advisors work with you to create tailored strategies that align with your unique business goals and circumstances.

- Market Analysis: Financial advisors keep abreast of market trends and can help you make informed decisions based on current economic conditions.

- Investment Insights: They can also provide guidance on where to invest your capital for maximum return and growth.

- Risk Management: Advisors help businesses mitigate risks and save money through effective financial planning.

Choosing the Right Financial Path for Your Business

When it comes to business financing, the right choice depends largely on your unique needs, goals, and circumstances. Here’s how to evaluate your options:

- Assess Your Financial Needs: Determine the amount of funding required and the purpose of the loan—whether it's for expansion, operational costs, or inventory.

- Research Financial Institutions: Compare offerings from various banks and credit unions to find favorable terms and conditions.

- Engage a Financial Advisor: Consult with a financial advisor to gain insights into the best financing options. They can provide a wealth of knowledge on available products tailored to your needs.

- Prepare Documentation: Ensure you have all necessary documentation prepared, including business plans, financial statements, and tax returns.

Leveraging Online Resources for Business Financial Solutions

In the digital age, there’s an abundance of resources available online. Websites such as https://superkredyty.com offer invaluable insights and tools for businesses seeking financing.

Benefits of Utilizing Online Resources

- Comparative Analysis: Easily compare different loan products and interest rates from multiple institutions.

- Access to Educational Content: Gain knowledge through articles, webinars, and guides offered by financial experts.

- Connection with Financial Advisors: Find and connect with financial advisors who can cater to your specific business needs.

- Convenient Application Processes: Many institutions offer online applications that simplify the process and reduce the time to funding.

Success Stories: Businesses That Thrived with the Right Financial Guidance

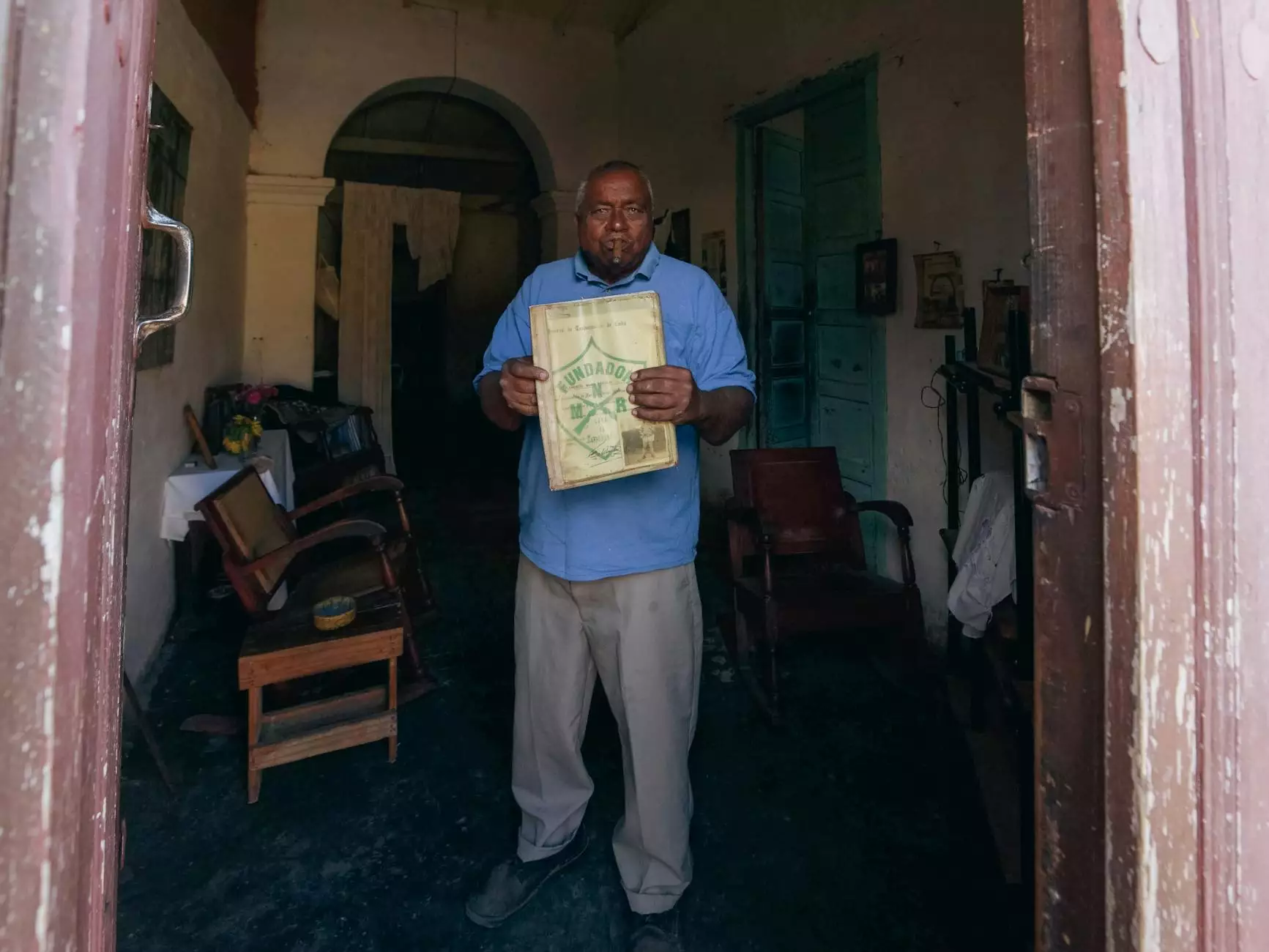

Many businesses have transformed their operations and significantly grown after accessing the right financial products and advice:

Case Study 1: A local bakery that struggled with cash flow secured a line of credit through a small bank, allowing them to purchase inventory during peak seasons, resulting in a 30% increase in revenue within a year.

Case Study 2: An e-commerce startup worked with a financial advisor to develop a business plan and received an SBA loan. This funding helped them launch their website and scale operations, ultimately leading to higher market penetration.

Conclusion: Taking the First Step Towards Business Growth

In conclusion, navigating the complex world of banks, credit unions, and financial advising is essential for any business looking to flourish. With resources like https://superkredyty.com at your disposal, you can empower yourself with knowledge and support, enabling informed financial decisions that foster growth. Assess your needs, explore your options, and engage the right partners to unlock your business's full potential.

Frequently Asked Questions (FAQs)

What type of financing is best for my business?

The ideal financing option depends on your specific needs, including the amount required, the purpose of the funds, and your repayment capabilities. Consult a financial advisor for personalized recommendations.

How can I improve my chances of getting approved for a loan?

Maintain a strong credit score, have a detailed business plan, and prepare all necessary financial documents. Establishing relationships with banks and credit unions can also improve your likelihood of approval.

Are credit unions a better option than banks?

Credit unions may offer better interest rates and personalized service, but the right choice ultimately depends on your individual situation and needs. Compare both options before deciding.

How do I know if I need a financial advisor?

If your business requires substantial funding, is expanding, or involves complex financial decisions, seeking a financial advisor may prove beneficial in creating a robust financial strategy.